Demystifying Sovereign Wealth Funds

Sovereign wealth funds (SWFs) have grown rapidly in recent years in both number and assets, emerging as significant and sometimes controversial players in global capital markets.

The Rise Of Sovereign Wealth Funds

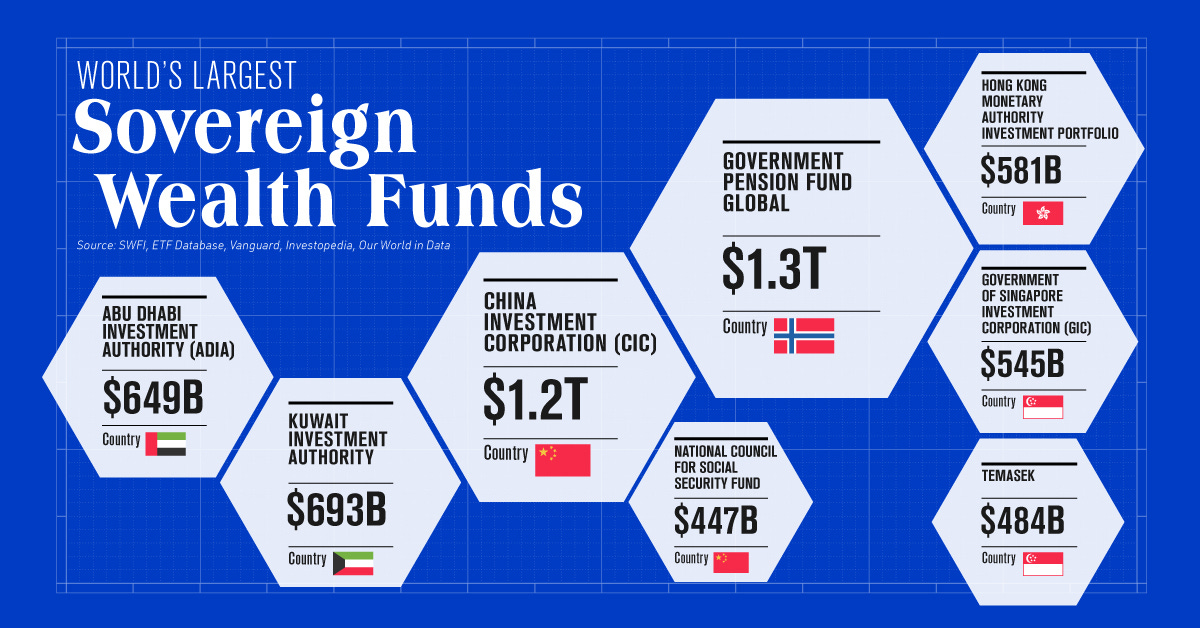

In the ever-shifting landscape of global finance, one class of funds has emerged as potent agents of political influence and guardians of national wealth. Enter the world of Sovereign Wealth Funds, where stories of investment are coupled with insight and intrigue. Twenty years ago, SWFs managed just US$1 trillion in assets, but this figure has since surged more than elevenfold to reach US$11.36 trillion by the end of 2023. Powerhouse organizations like the Public Investment Fund (PIF) of Saudi Arabia, the Abu Dhabi Investment Authority (ADIA), and Singapore’s Global Infrastructure Partners (GIG) are not only players in the global investment arena – they are architects and masterminds of economic transition on an unprecedented scale.

SWFs are government-controlled investment vehicles tasked with managing and deploying a nation's financial reserves. They strategically harness wealth derived from various resources, often from oil, to build financial security and secure economic well-being. According to the Milken Institute, “Governments use SWFs to meet their particular economic goals, for example, to help stabilize the country’s economic base through asset diversification, to increase the returns via international portfolio investments, to limit the effects of capital flows on money supply, and to protect against price volatility and boom-and-bust cycles.” The term "Sovereign Wealth Fund" was first coined by Andrew Rozanov in 2005, marking the crystallization of a distinct financial entity, but SWFs existed long before then.

Among the early pioneers of SWFs, the Kuwait Investment Authority (KIA) stands as a testament to astute resource management. It was established in 1953 to manage Kuwait's surging oil wealth, laying the foundation for financial stability and resilience in the years to come. The fund invested in everything from global equities to real estate, grounded in a strategy aimed at safeguarding the nation's wealth.

Kiribati's Revenue Equalization Reserve Fund (RERF) was another early SWF, established in the small island nation of Kiribati in the Pacific Ocean. It was created to manage income generated from phosphate mining in the 1950s, a lucrative industry but one with a finite lifetime. The establishment of RERF was a visionary act of Kiribati's leadership, ensuring that the wealth generated from this non-renewable resource would be preserved and used for the country's future development, especially once their phosphate reserves began to diminish.

SWFs operate under varying degrees of transparency and accountability, largely influenced by their home countries' governance structures. Some are subject to stringent regulations and reporting requirements, while others operate with more flexibility. The effectiveness of potential and existing oversight mechanisms is a subject of ongoing debate. Too much government influence can lead to inefficient investments, while too little oversight can pose risks to the fund's integrity. International protocols like the Santiago Principles have sought to establish best practices and encourage greater transparency among SWFs.

The Public Investment Fund And Strategic Diversification

In Saudi Arabia, the PIF is directly and intricately tied to Crown Prince Mohammed bin Salman, known as MBS. This connection reflects not only MBS's vision for Saudi Arabia's future but also his personal involvement in shaping the PIF's trajectory. The de facto ruler of Saudi Arabia has been the driving force behind the PIF's transformation from a relatively conservative sovereign wealth fund into a dynamic and ambitious investment vehicle. Under his leadership, the PIF has become a cornerstone of Saudi Arabia's ambitious economic diversification agenda, known as Vision 2030. This vision aims to reduce the nation's reliance on oil revenue and stimulate growth in non-oil sectors.

The PIF has strategically diversified its international operations in a range of sectors. Its investment in Lucid Motors signifies active participation in the electric vehicle revolution, which is noteworthy for a country dependent on non-renewable energy. The fund has demonstrated a commitment to emerging technologies and innovation through a massive partnership with the SoftBank Vision Fund. Their collaboration with Blackstone, another leading financial institution, will target investment in real estate and infrastructure around the world. These ventures underscore the PIF's critical role in diversifying Saudi Arabia's economy in strategic sectors and bolstering its presence in the global economy.

Qatar’s Investment Authority And Overseas Investment

Bordering Saudi Arabia, the oil-rich state of Qatar has amplified its international investment through the Qatar Investment Authority (QIA). It is responsible for “[investing] the nation's surpluses to secure the prosperity of future generations”. In line with its mandate, QIA adheres to a resolute commitment to "create long-term value for the State and future generations." One of QIA's most iconic investments is The Shard, a London skyscraper situated south of the River Thames. It is the tallest building in the United Kingdom. This skyscraper is a physical manifestation of QIA's extensive global reach, with investments spanning from London's Canary Wharf to brands like Harrods and a stake in Paris Saint Germain football club.

The returns on splashy purchases like iconic landmarks and high-profile properties, such as those owned by the QIA, can vary significantly in the short term and the long term. In the short term, these investments may not always generate immediate financial returns; for example, high-profile properties often require substantial maintenance and operating costs. However, over the long term, these investments are expected to produce consistent and substantial returns. Iconic properties in prime locations tend to appreciate over time, and rental income can provide a stable revenue stream.

The QIA's investment strategy is anchored in five core principles, two of which hold particular significance. First, the fund has a long-term investment horizon, positioning itself as a patient source of capital. This orientation enables it to navigate market volatility while generating sustainable returns over extended periods. Secondly, the QIA seeks to build strategic external partnerships to complement its in-house capabilities. However, the QIA is notably one of the least transparent sovereign wealth funds. This raises questions regarding accountability and governance, as public scrutiny of the fund's activities inside and outside of Qatar is limited.

Fund Transparency And Accountability

While the QIA has garnered recognition for its global investments, the fund has also faced scrutiny regarding conflicts of interest and offshoot projects. One example is the opulent One Hyde Park, a London apartment complex with prestigious tenants like Abu Dhabi Islamic Bank, McLaren Automotive, and Rolex. What makes this project complicated is its developer, Hamad bin Jassim bin Jaber Al Thani, often referred to as HBJ. He played a key role in overseeing the Qatari sovereign wealth fund until 2013. The "Man Who Bought London" moniker associated with HBJ, highlights the extent of Qatari royal and political influence within the country and beyond. This convergence of personal involvement, luxury real estate, and high-profile tenants exemplifies the complicated intersection of business and government. Moreover, the level of oversight surrounding the sale of key assets is a concern that requires careful consideration. While foreign investment can bring economic benefits, it also raises legitimate questions about national security and control over critical infrastructure.

In the United Arab Emirates, The Abu Dhabi Investment Authority (ADIA) sets a higher standard of transparency by disclosing the percentages of its portfolio allocated to different regions. Like the QIA, the ADIA has an expansive footprint that spans the globe, with investments that stretch from China to India and beyond. The Abu Dhabi-based fund has proven willing to identify opportunities in both emerging and established markets. It has also adopted a long-term horizon and releases only 20 and 30-year returns, because they are the only relevant metrics to them. This trend mirrors the industry at large. According to Invesco’s annual sovereign asset management report, “Investors continued to extend their investment time horizons resulting in the sixth consecutive annual increase reported through this study. Sovereign wealth funds reported an average investment horizon of 11.3 years, versus the 10.7 years reported in 2022.”

Prospects For The Next Decade

SWFs are positioned to continue acquiring high-value properties in major cities including iconic landmarks. Echoing broader industry trends, they are moving away from retail and office and towards alternative segments of the real estate industry. Across the board, SWFs are most interested in industrial space, healthcare centers, and data centers. Also, they have been increasingly drawn to venture capital investments, either through direct involvement in startups or through funds offering high return potential. During the period from 2014 to 2019, SWF investment “averaged 57 deals and 11 SWFs joining VC rounds each year.” In the post-pandemic landscape, with diminishing returns on traditional investments, there is reason for this trend to persist.

In both the public and private sectors, SWFs tend to seek equity stakes in companies that align with their domestic and international economic and political objectives, spanning diverse industries like healthcare, finance, technology, and infrastructure. As for infrastructure, some countries may impose restrictions on foreign investments in critical sectors such as airports, ports, toll roads, and utilities. Industries of national interest, such as defense, telecommunications, and aerospace, could also come under increased scrutiny. The debate on whether this approach is geopolitically sound or inhibitory to innovation and competition remains ongoing. In all cases, SWF employees and associated individuals in government must make responsible decisions on investment matters and otherwise. Saudi Arabian royalty came under fire for Jamal Khashoggi’s murder in Istanbul, slowing the realization of Mohammed Bin Salman’s vision.

With the impending green transition, many SWFs will direct investment towards renewable energy generation. The most inclined funds may be in Western countries, where there exists significant public demand to reduce carbon emissions, and according to some research, in emerging markets. As global gas prices and production remain volatile, countries capable of domestically producing energy gain a distinct strategic advantage.

SWFs could extend their reach into regions like Africa and Latin America, especially if these areas can mitigate political and economic risks and improve their infrastructure. Geographic diversification is central to SWF strategy, and regions like Africa and Latin America offer substantial economic potential and a growing middle class. The realization of such a geographic shift hinges on the distinct objectives and risk tolerance of each fund. Nevertheless, as sovereign wealth funds continue to evolve, they will almost certainly stand at the forefront of global finance as both economic powerhouses and instruments of political influence.

It has been said that the economic model used by Japan and the South Korean government to grow their national economies in a few decades has been a combination of protectionism, favoritism of several chosen companies by subsidies, loans, and labor laws, and export-focused industrial policy. The goal of these factors were to create a few highly competitive companies to compete in global industries in order to create economic growth even if it came at the cost of domestic competition. The results of this was indeed a sustainable source of foreign currency and economic activity from these companies. However, they have also led to a variety of political issues and unrest because of the mismatched economy and uneven growth that they have caused at home. These companies have turned from private ventures to nationally important institutions. That does not even mention the political influence and corruption invovled during the creation and maintenance of these companies as this was not a completely objective process.

I see these funds as a centralized way to plan the consolidation and use of the economic capital of the nation in order to take advantage of the scale that this consolidation provides. This seems similar to the plan described above except in that they outsource the actual economic activity to another entity. If the citizens do own them in theory, then these funds might have a more equitable outcome in theory instead of the uneven economic growth that resulted in South Korea and Japan. Do you think that the outcome these funds will be anything like the results of South Korea's and Japan's previous economic models?

In addition, the size of these funds and the fact that many are controlled in some way by the national government means that political considerations are included in their use no matter what their official purpose is. I predict that the two short-term consequences of this will be that the funds will be used to support partisan goals and that the fund will be used to support strategic goals. I believe that Norway's fund's intent to invest its funds specifically in goals to promote environmentalism, women's rights, and social justice is an example of this. We already see examples of the second consequence which you have implied in your post. I believe that this will either lead to funds becoming explicitly politicized with their decision making being tied to elections, or their independence will become heavily restricted and tied to only a few avenues in which they can invest. What do you think that the perception of these institutions will be?

China, through the China Investment Corporation (CIC) has claimed 384,235 acres of American farmland soil, with a single Chinese billionaire owning more than half the property, per NYP.